|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

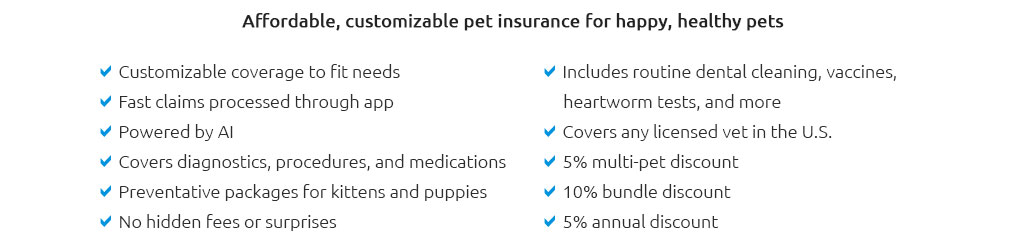

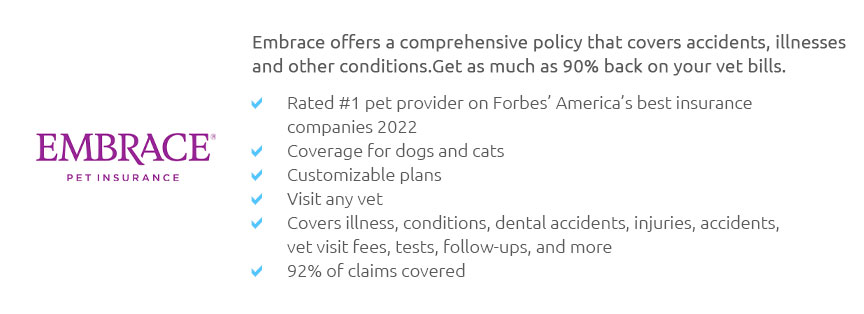

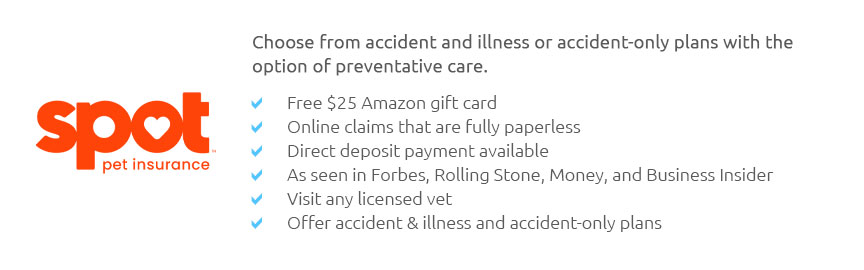

Understanding Low-Cost Pet Insurance: What You Need to KnowIn the realm of pet ownership, one aspect that often gets overshadowed by the more immediate joys of companionship is the importance of securing pet insurance. Particularly, low-cost pet insurance is becoming an attractive option for many pet parents who wish to safeguard their furry friends without breaking the bank. But how exactly does it work, and what should potential buyers be aware of? Let's delve into the intricacies of this essential yet affordable financial tool. First and foremost, low-cost pet insurance is designed to provide a financial safety net against unforeseen veterinary expenses. Much like any other form of insurance, it involves a monthly premium that policyholders pay in exchange for coverage on certain health-related costs. These policies can vary significantly in terms of what they cover, which is why it's crucial for pet owners to thoroughly research and understand the specifics of each plan. Generally, low-cost options tend to offer coverage for emergencies, accidents, and basic illnesses, while more comprehensive plans may include preventive care and wellness visits. For those considering low-cost pet insurance, it's important to examine the deductibles and reimbursement rates. Deductibles are the out-of-pocket expenses that you must pay before the insurance kicks in, and these can vary widely. A higher deductible often corresponds to a lower monthly premium, which can be appealing if you are primarily seeking coverage for catastrophic events rather than routine care. Reimbursement rates, on the other hand, determine what percentage of the vet bill the insurance will cover after the deductible has been met. Typical rates range from 70% to 90%, with lower-cost plans generally offering the lower end of the spectrum. When evaluating different insurance options, it is also beneficial to consider the exclusions that might apply. Many low-cost plans will exclude pre-existing conditions, hereditary issues, or certain breed-specific ailments, which could be a deal-breaker for some pet owners. Therefore, it is vital to read the fine print and understand any limitations that might affect your particular pet. Another point worth noting is the network of veterinarians associated with your chosen insurance provider. Some insurers offer plans that are accepted by a broad range of vets, while others may have more restrictive networks. Ensuring that your preferred veterinarian is within the network can save you significant hassle and ensure that your pet receives the care it needs without unexpected costs. One might wonder, is low-cost pet insurance truly worth it? The answer often depends on your personal financial situation and your pet's health needs. For many, the peace of mind that comes from knowing that they won't face insurmountable vet bills in the event of an emergency is well worth the modest monthly fee. Moreover, some insurers offer customizable plans, allowing you to tailor coverage to better fit your pet's lifestyle and your budget, which can be a game-changer for those seeking both affordability and comprehensive care.

In conclusion, while low-cost pet insurance may not cover every eventuality, it provides a valuable layer of protection that can alleviate financial strain during challenging times. By approaching the selection process thoughtfully and informed, pet owners can secure a plan that not only fits their budget but also meets their beloved pet's health requirements. This careful consideration ensures that both owner and pet can enjoy their shared life together with an added sense of security. https://www.freeway.com/insurance-options/pet-insurance/

Are you a pet owner who is worried about the cost of veterinarian expenses? Freeway Insurance has partnered with the ASPCA Pet Health Insurance program to ... https://www.aspcapetinsurance.com/pet-insurance-plan/

Our Lower-Cost Plan. Accident-only Coverage. Accident-only is our accident and emergency pet insurance plan that gives you cash back for the eligible costs of ... https://www.geico.com/pet-insurance/

The GEICO Insurance Agency can help you get comprehensive pet insurance coverage for your dogs and cats. Get a free online quote and see how affordable pet ...

|